It’s crucial that you know that i do use an acceptance procedure to have individual purchases. The fact more and more people currently have the cell phones from the able makes NFC-let contactless repayments more easier way to pay. NFC is the technology you to definitely’s from the gamble here — it’s how mobile device plus the NFC-allowed point-of-sales system talk-back and forward to one another so you can techniques a fees. The new products have to be intimate, even though (that’s where “near” part of close occupation communications comes in).

Click This Link: Explore a loyalty or benefits credit and you may Fruit Spend

Your wear’t features a real credit history, very banking companies would be being unsure of regarding the capability to repay everything you obtain. Because of this first-time credit card users have large APRs as opposed to those one have used credit cards for many years. A credit card could also be helpful you have to pay for goods today which have currency that you wear’t but really have.

Were there costs for using your own mastercard?

Cellular phone money is actually a safe and easier solution to manage purchases inside casinos on the internet. If you need local casino charges in your cellular telephone costs rather than the lender statement, this process will be appealing to you. Since the spend by cellular phone bill is considered one of many safest and you can widely used percentage actions in the Southern African casinos on the internet, we all know may possibly not become suitable for individuals. Thus far, you are trying to find taking in initial deposit incentive thanks to spend-by-cellular phone deals. It’s crucial that you keep in mind that certain percentage steps do not qualify to possess added bonus accumulation. That it usually relates to age-purses including Neteller and you will Skrill, and therefore people have already accustomed mine added bonus possibilities.

For many who constantly set off carrying your own cell phone, but never love carrying your own purse, this article to paying which have a cards or debit card and you can your smart phone is actually for you. And make mobile repayments having borrowing otherwise debit along with work much like making physical costs. When you swipe, faucet or enter their borrowing from the bank otherwise debit card on the a simple mastercard critical, the fresh cards reader accumulates all the details kept on your own card and spends they doing the transaction. Paying along with your cell phone functions in the sense, it’s that the credit card info is held on the a cellular phone application as opposed to an item of synthetic.

Punters is now able to bet via Age-purses and also with cryptocurrencies according to the playing web site. However, in past times number of years, shell out by cellular telephone expenses gambling could have been going around. Are the touching ID, facial detection and you may passcodes you to definitely include the mobile phone, and you may Fruit Spend is probably safe than other payment steps.

Only apply for one qualified UnionBank credit card via Moneymax, get approved in the promo period, and meet with the ₱10,000 invest demands inside 60 days from the card approval day. Anytime which you build in initial deposit to an on-line gambling establishment, Siru Cellular will be sending you an enthusiastic Texts requesting you to definitely authorize the fresh put transaction. After you do that they usually techniques the transaction quick to you. When you wish making in initial deposit having an internet gambling establishment you are going to discovered a permission key out of Zimpler. At the time of creating there are various online casinos one to include with Zimpler and they plan for far more integrations.

They shop their payment options, such as Click This Link borrowing and debit cards, letting you conveniently make use of your mobile or smartwatch and then make a purchase. Square now offers a great powerhouse room from commission processing and business administration equipment. That have clear costs, an entire selection of commission possibilities and you will smooth promote-anywhere provides, it’s not surprising that Rectangular have couple competitors. Thanks to the scholar-friendly structure, learning how to have fun with Square in order to procedure credit cards requires simply moments. You could start recognizing payments after you install your own the brand new Rectangular account.

For many who don’t have WeChat mounted on the cellular phone, read the steps less than. To possess current WeChat users, pursue steps 3 thanks to 5 to arrange the fresh Shell out form. For individuals who’lso are fresh to one another Alipay and you will WeChat Pay apps, my personal tip is to get Alipay. You’ll come across the installation and software procedure smoother and much more intuitive having recommendations inside the English.

If so, bring your cellular telephone, unlock it, following hold on a minute close to the contactless percentage device from the checkout. If you have several cards, merely swipe left otherwise straight to find the credit you want to spend having. The brand new card you place because the standard was used in the event the you wear’t swipe. Generally, contactless repayments have been limited to £30 in the united kingdom, but which not true in lots of areas today, for the limit eliminated to the Apple Spend and also the anybody else functions within this list. Tap to spend are a phrase for acknowledging contactless repayments to the your own iphone otherwise Android mobile phone rather than a new card audience. This is not just like tap and you will go, a term popularised around australia to explain contactless payments generally speaking.

- Install Fruit Pay via the Purse application in your new iphone otherwise your own financial app.

- The procedure can differ — however, generally your’ll must see Costs Shell out, find the kind of statement we should pay (in this case, mastercard) and you will go into your account information.

- It added bonus are projected as well worth $step one,200 according to TPG’s valuations.

- The cellphones always believe an external tool to just accept credit repayments.

- I’ve rated an educated spend mobile phone because of the expenses casino web sites to own United kingdom people.

- You will see a full list of appropriate banks to your Apple’s site.

- Smartphone, wire and websites business usually enable it to be bank card payments.

- For individuals who’lso are fortunate enough in order to lease from a friends with increased excellent bookkeeping, contemplate using their credit card to spend the rent, particularly when truth be told there’s zero percentage to your benefits.

Public charging you programs expose an additional risk so you can users. As a result of a work named “juices jerking,” hackers is also stream malware to your form of mutual asking stations are not found in coffee shops otherwise flight terminals. One advice introduced due to one of them social systems otherwise stations can be acquired to your public in particular, considering they know tips cheat. Deleting a payment card out of Samsung Spend is only going to remove the payment information, like the token (digital credit matter), regarding the unit.

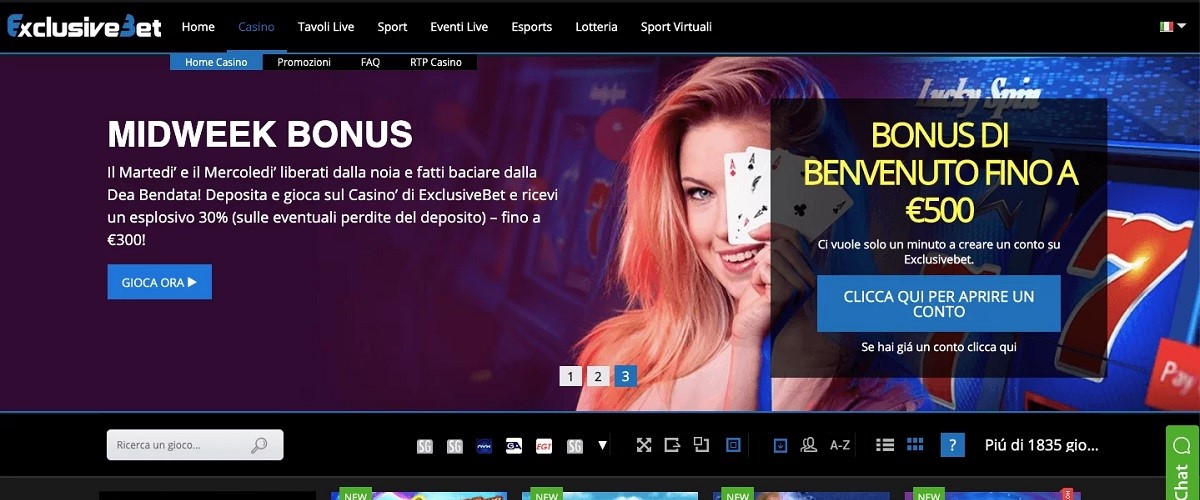

Merely come across “shell out by the cell phone” on the repayments webpage, enter into your deposit count and prove and ensure the order. You need to check that you aren’t damaging the laws and regulations of your own nation from the to try out cellular casinos one to deal with commission through cellular phone. Fortunately here’s that all shell out by mobile phone gambling enterprises gives bonuses particularly when your subscribe be a good fellow member.

There are no limits to the including an identical fee card in order to numerous devices. Such, for those who along with your spouse share a charge card, you can include the newest card in order to both products. The entire level of gadgets you can a comparable cards in order to may vary by the card issuer. When a contactless commission is established (from the a customers carrying otherwise scraping a smart phone to the repayments terminal), the new NFC tech goes to works. Having fun with that one volume we chatted about, the fresh NFC-allowed audience plus the portable ticket encrypted guidance to and fro to each other to do the fresh percentage.

However, for the majority towns, especially in website visitors-amicable metropolitan areas including Seoul, Busan, and you will Gyeongju, international credit cards might be acknowledged without any troubles. Talking about becoming more popular as a way to pay currency whenever seeing Korea and you can a means to maybe save money versus. investing dollars. Rectangular try a convenient and you may less expensive way to processes handmade cards for both within the-person and online conversion process, but that simply damage the exterior of all the one to Square features giving. Square’s impressive collection from payment, transformation and you can business administration products is going to be designed to complement the brand new requires from some other business, front side concert otherwise small business. There are many downsides to presenting Rectangular, although not, its reliability, convenience and full really worth ensure it is a high competitor to the one listing of small company percentage options.

Establishing on line costs shell out along with your bank otherwise borrowing from the bank relationship is usually a simple and easy processes, and normally 100 percent free. As of this composing, Lazada does not deal with percentage due to GCredit. You could potentially only pay their bought product/s within the Lazada using your real normal GCash purse harmony. It’s the same as a credit card however, without having to apply at and become approved by banking companies.